Voltron says: All of Wells Fargo's profits this year could be wiped out by second mortgage losses (and yet the stock price goes up...)

Excerpt:

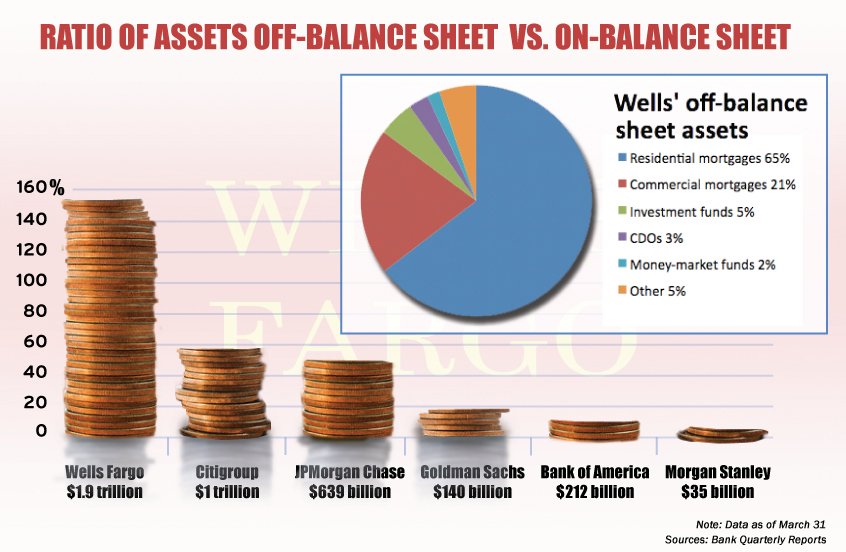

Wells Fargo holds about $123.8 billion of home-equity loans, with about $103.7 billion in a junior-lien position, according to company filings. The lender has $5.3 billion in reserves set aside to cover the second-lien mortgage loans and wrote off $4.6 billion last year. Almost 2.2 percent of the second liens are more than 120 days past due, the company said in its annual report.

CreditSights said potential home-equity losses could knock $12.8 billion, or $2.47 a share, off earnings at Wells Fargo. That's more than the $10.9 billion the bank is expected to earn this year, according to the average estimate of 15 analysts surveyed by Bloomberg.

..

Second-lien reserves set aside by the four big banks are $100 billion to $125 billion short of what's needed in the next few years, said Joshua Rosner, an analyst at Graham Fisher & Co., an independent research firm based in New York, and co- author of a May 2007 report that said ratings companies were underestimating the risk of subprime-mortgage bonds.

Quotes:

"There's very little recovery for home-equity loans," -Paul Miller, FBR Capital Markets

"If banks were properly accounting for their second liens, there would be no problem with them choosing to do principal writedowns, They would already be reserved for it." - Joshua Rosner, Graham Fisher & Co.

"Banks have been saying we're close to the end, People have built that into their expectations. I don't think we're there yet." -Nancy Bush, NAB Research

"The banks are saying that they can work through it . . . it may be bigger than they are letting on." -Baylor Lancaster, CreditSights

"This is a problem that's not going away for several years," -Charles W. Scharf, JPMorgan

http://www.bloomberg.com/apps/news?pid=20601206&sid=ayhRMX.B.hJE